30+ Online payroll calculator 2021

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Calculate paychecks and prepare payroll any time.

Payroll Deductions Teaching Resources Teachers Pay Teachers

Double check your calculations for hourly employees or make sure your salaried.

. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Enter your info to see your take home pay. If you need a little extra help running payroll our calculators are here to help.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Start Afresh in 2022. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

No Need to Transfer Your Old Payroll Data into the New Year. Paycheck Manager is designed to make these tasks simple. Taxes Paid Filed - 100 Guarantee.

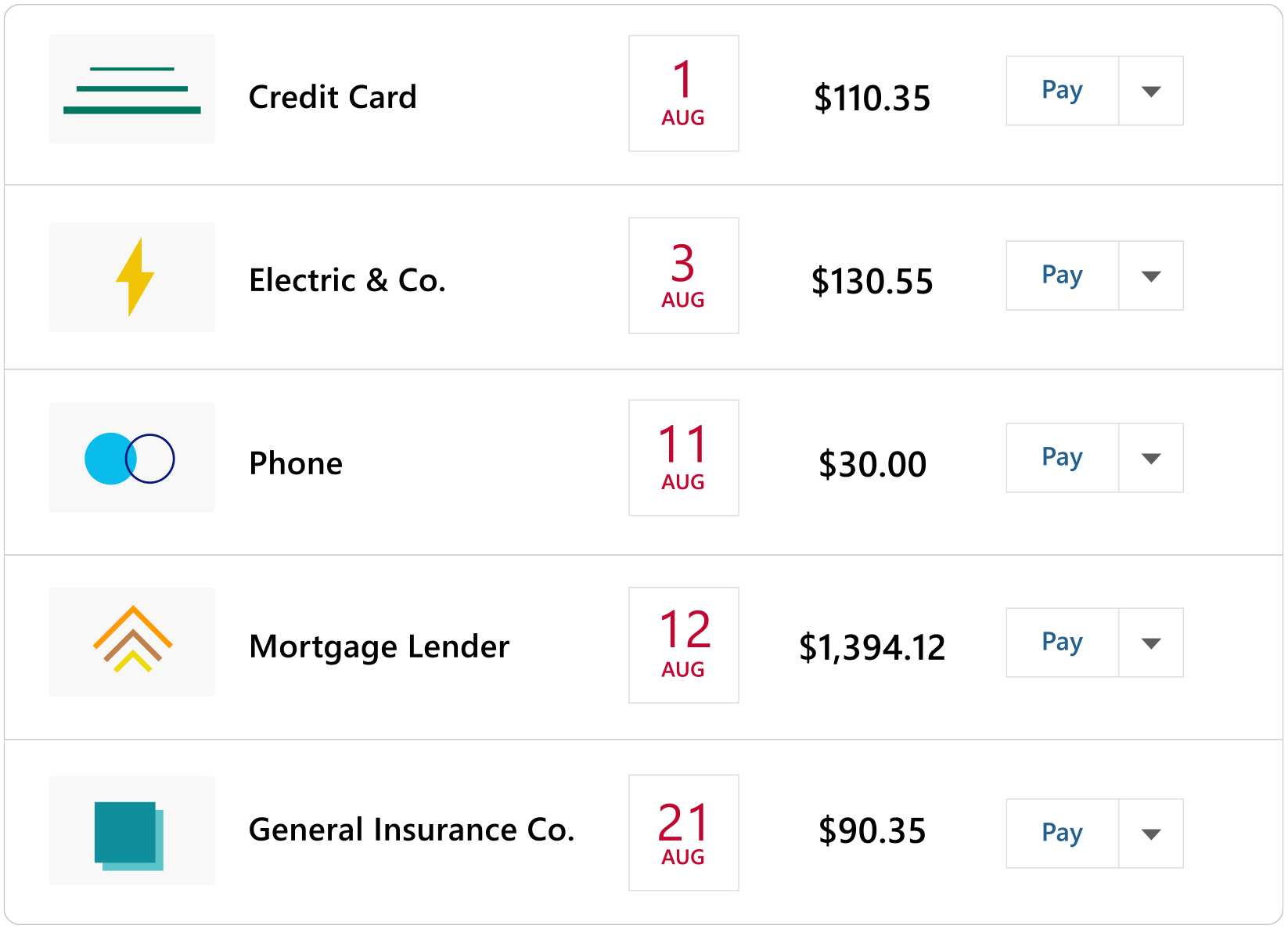

No Need to Transfer Your Old Payroll Data into the New Year. Be reminded of pending. Rules for calculating payroll taxes.

For example if an employee earns 1500. Federal Salary Paycheck Calculator. Find Easy-to-Use Online Payroll Companies Now.

Free Unbiased Reviews Top Picks. Ad See the Calculator Tools your competitors are already using - Start Now. Computes federal and state tax withholding for.

Find Easy-to-Use Online Payroll Companies Now. Yearly Semi-annually Quarterly Monthly Bimonthly Biweekly Weekly Daily. Small Business Low-Priced Payroll Service.

3 Months Free Trial. Next divide this number from the. Ad Compare This Years Top 5 Free Payroll Software.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Form TD1-IN Determination of Exemption of an Indians Employment Income. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Free salary hourly and more paycheck calculators. Free 2021 Payroll Deductions Calculator.

When you choose SurePayroll to handle your small business payroll. Start Afresh in 2022. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Ad Payroll Doesnt Have to Be a Hassle Anymore. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. We hope these calculators are useful to you.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. How do I calculate hourly rate. Ad Compare This Years Top 5 Free Payroll Software.

Heres a step-by-step guide to walk you through. Starting as Low as 6Month. Free Unbiased Reviews Top Picks.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Ad Payroll So Easy You Can Set It Up Run It Yourself. GetApp has the Tools you need to stay ahead of the competition.

With the online paycheck calculator software you can. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. How to calculate annual income.

You can enter your current payroll information and. Use this calculator to help you determine the impact of changing your payroll deductions. Payroll Solutions that cover Payroll HR Benefits and Time Attendance solutions.

Updated September 30 2021. Ad All Payroll Services in One Place. Ad Payroll Doesnt Have to Be a Hassle Anymore.

If payroll is too time consuming for you to handle were here to help you out. It will confirm the deductions you include on your. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Printable Weekly Payroll Worksheet Payroll Template Payroll Business Template

Payroll And Ownership Worksheet Payroll Template Payroll Business Template

Quicken Home Business Quicken

How Do I Get Past This Error To Proceed Setting Up Qbo The Amounts Entered May Be Incorrect Ss Amp Medicare Taxes Fica Are Expected To Be Percentages

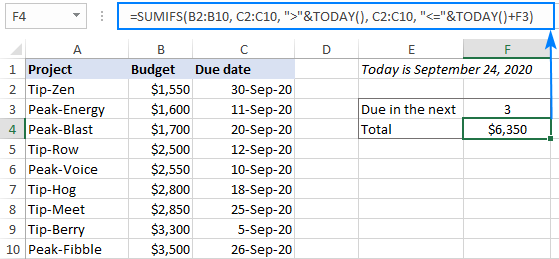

Excel Sumifs Date Range Formula Sum If Between Two Dates

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Hr Payroll Software Automate Payroll Prep With Grove Hr

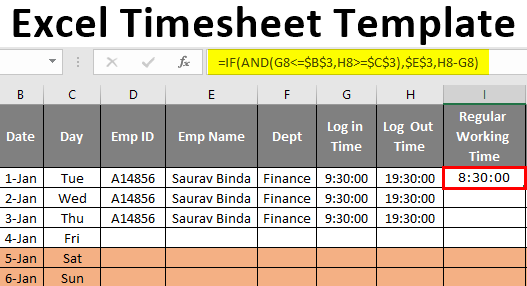

Excel Timesheet Template Creating Employee Timesheet Template

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Healthcare Merriman

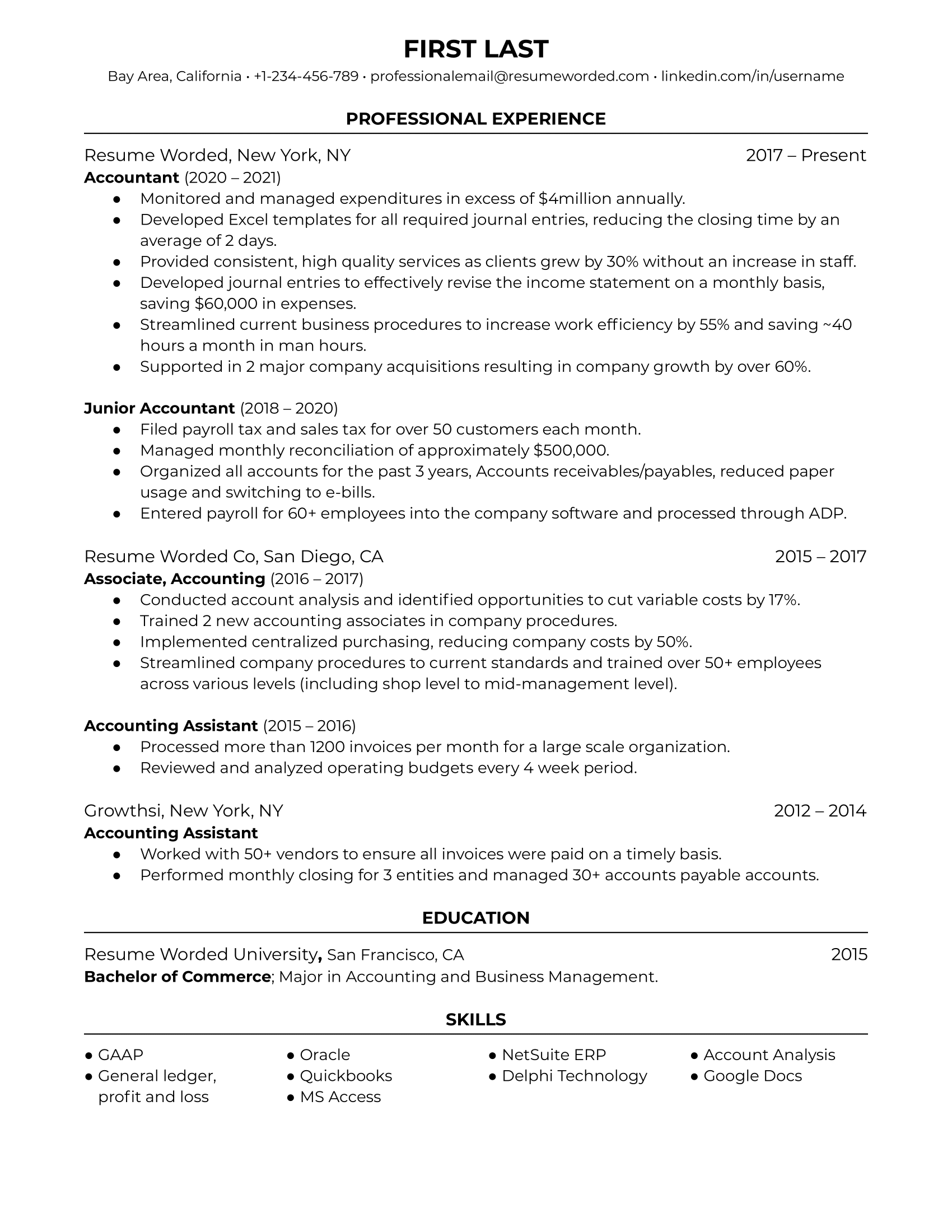

11 Accountant Resume Examples For 2022 Resume Worded

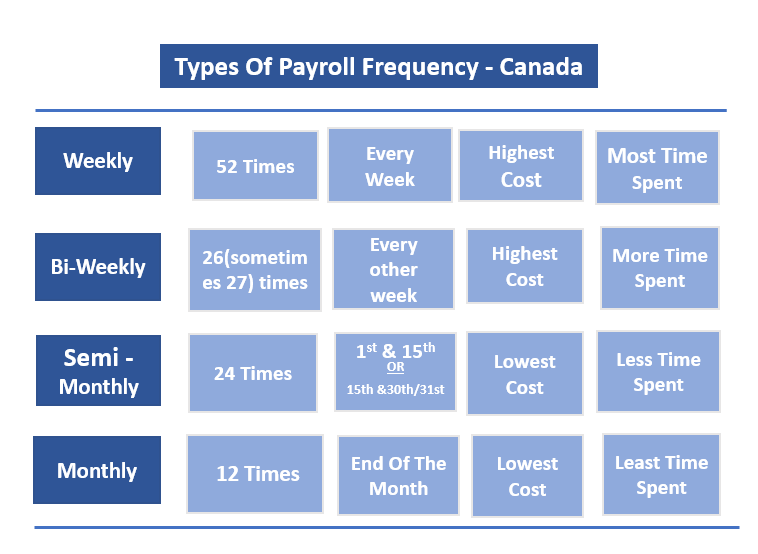

Everything You Need To Know About Running Payroll In Canada

Walmart Pay Stub Template Samples Of Paystubs Nurul Amal In 2022 Payroll Template Statement Template Professional Templates

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Gusto Reviews Ratings 2022

30 Startups To Watch The Startups That Caught Our Eye In March 2022

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks